Title

00

MINT

Title Slide

Deploy Capital at Machine Speed

Opening (01-07)

01

Deploy Capital at Machine Speed

Statement

MINT is capital infrastructure that transforms how money moves.

Evidence

We extract Fortune 500 debt out of ERP systems and pull a million invoices every 36 seconds.

Close

That produces an asset that didn't exist before, yielding 16%.

02

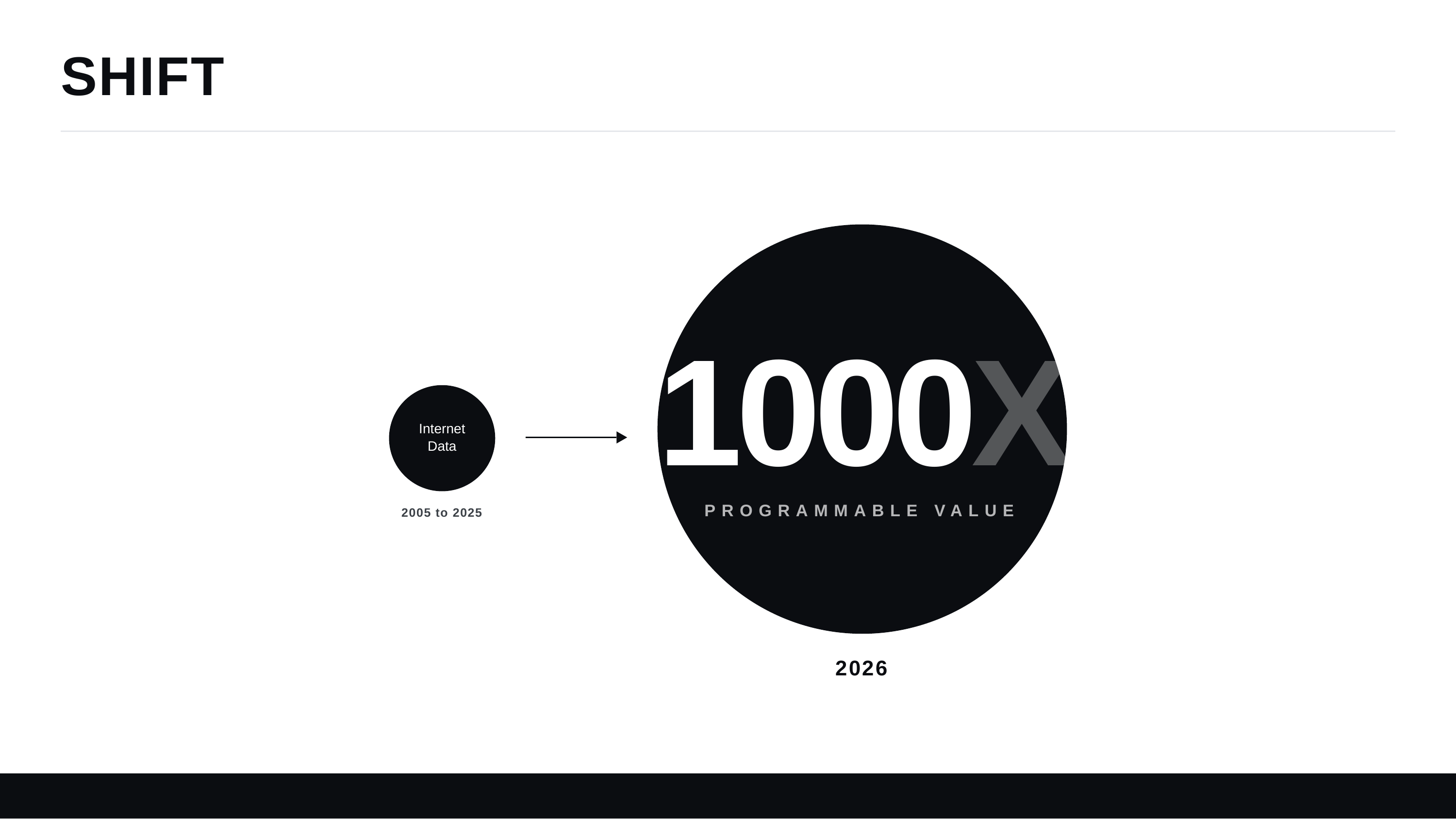

The Shift: Programmable Value

Statement

There's a part of our economy that's a thousand times bigger than every internet company combined.

Evidence

The shift from internet data over the past 20 years to programmable value.

Close

The broader trend: making programmable money move faster.

03

Growth Math Has Gone Nuclear

Statement

We are witnessing companies do things we never thought possible.

Evidence

Mercor: $1M to $100M ARR in 11 months. Hyperliquid: $109M revenue per employee vs Nasdaq's $123K.

Close

Right now is the most important time in history for anyone in finance to rethink assets, how they move, and position yourselves for the future.

04

Opportunity: $22 Trillion Up for Grabs

Statement

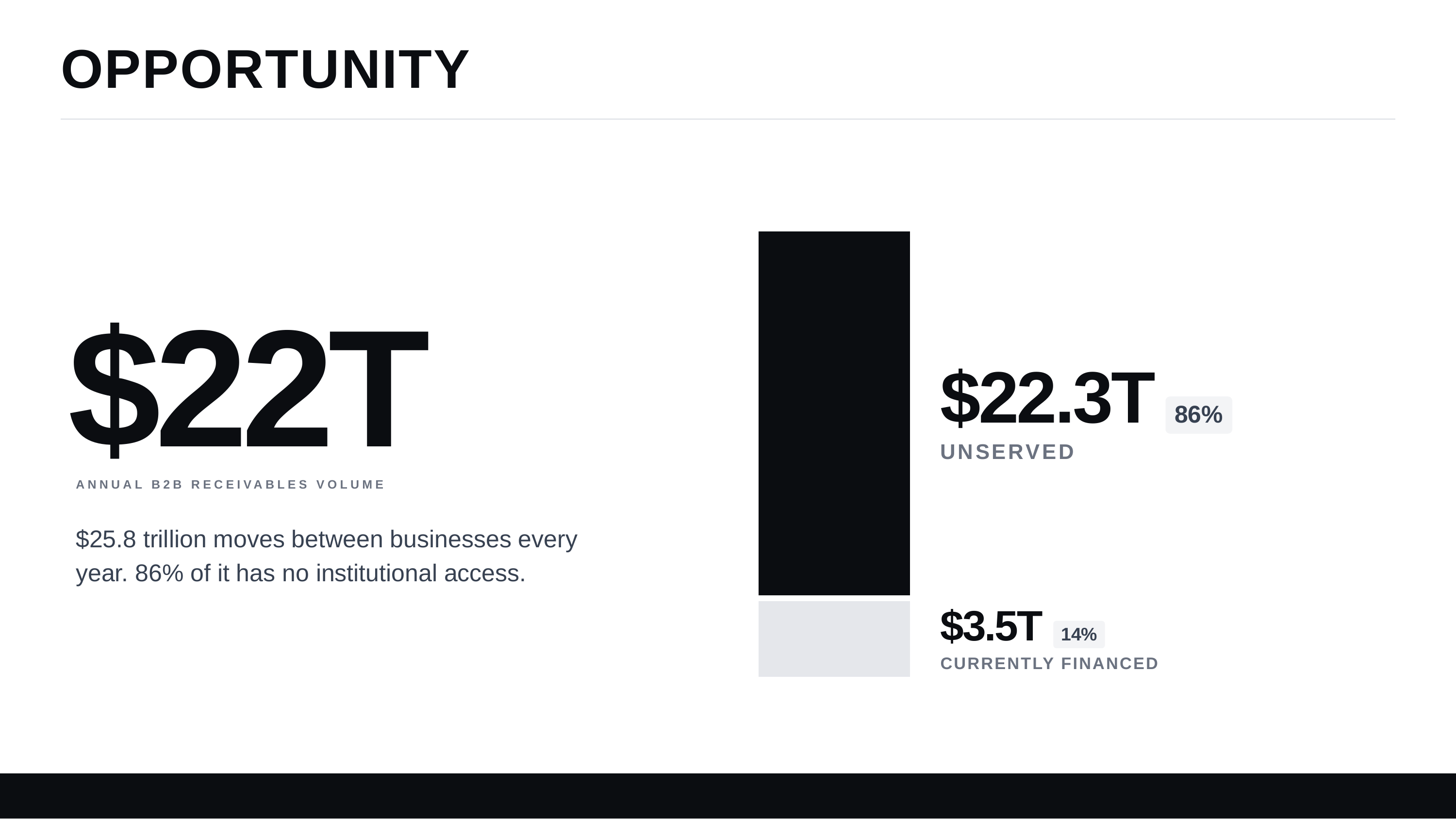

$25.8 trillion moves between businesses every year. 86% has no institutional access.

Evidence

$22.3T unserved vs $3.5T currently financed.

Close

Technology has caught up. The world's assets have opened up.

05

Locked: Corporate Receivables Stuck

Statement

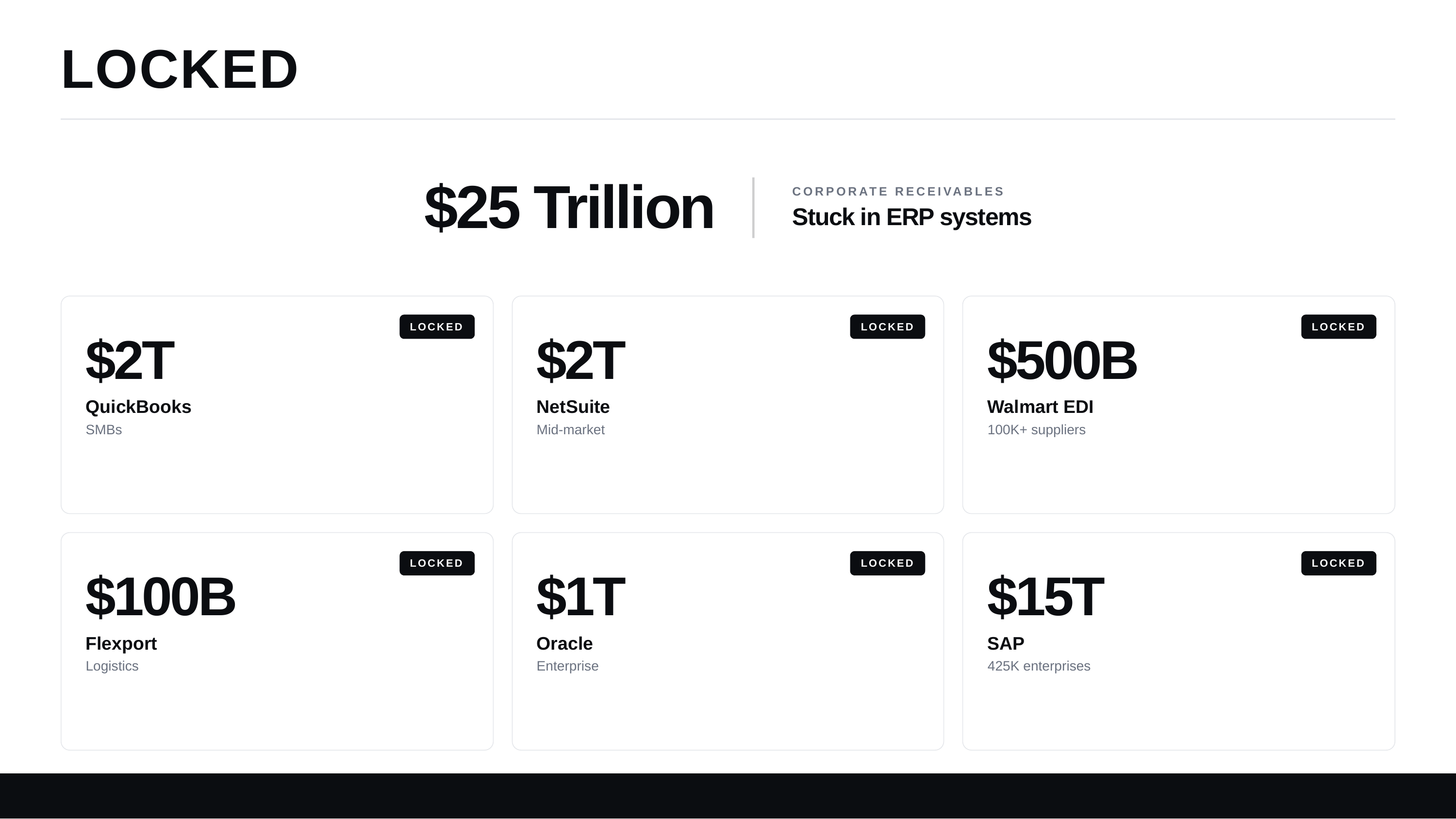

Capital exists. It's stuck in slow-moving enterprise software.

Evidence

SAP: $15T across 425K enterprises. Oracle: $1T. NetSuite: $2T. QuickBooks: $2T.

Close

I've been staring at these ERP systems for the past two decades.

06

Builder: Murphy's Bio

Statement

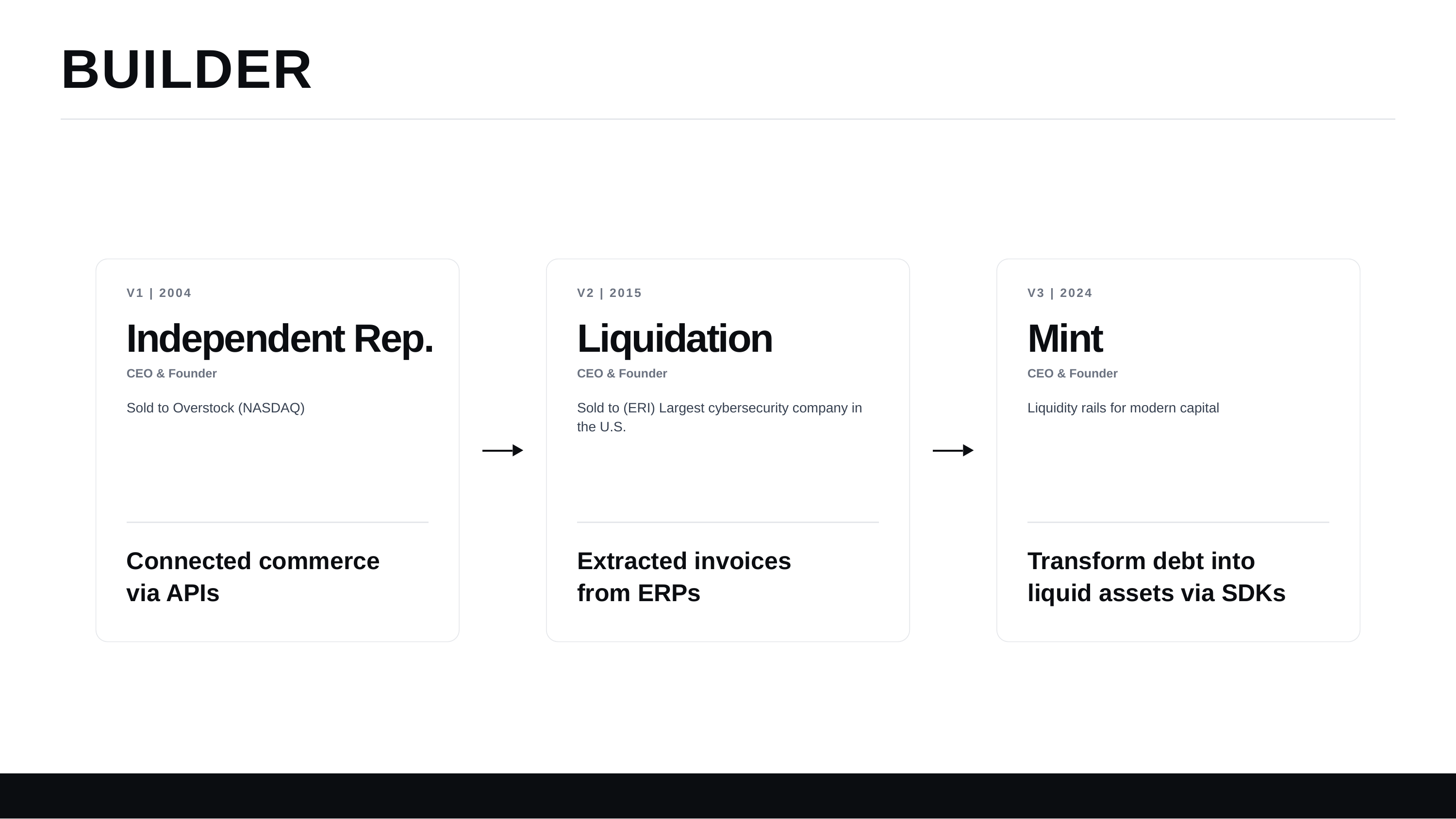

A CEO/founder of the past two decades building companies in AI, APIs.

Evidence

V1 (2004): Sold to Overstock. V2 (2015): Sold to ERI. V3 (2024): MINT.

Close

I've been on the hunt for ways that technology could give us our freedom back.

07

Vision: Maximize Human Freedom

Statement

For the first time in history, the immutable laws of code and mathematics have caught up, and no one is above these laws.

Evidence

We thought there was no great company taking on big banks and seeking truth. So we decided to be that company.

Close

Big vision. The first thing to do is put together a team.

How It Works (08-15)

08

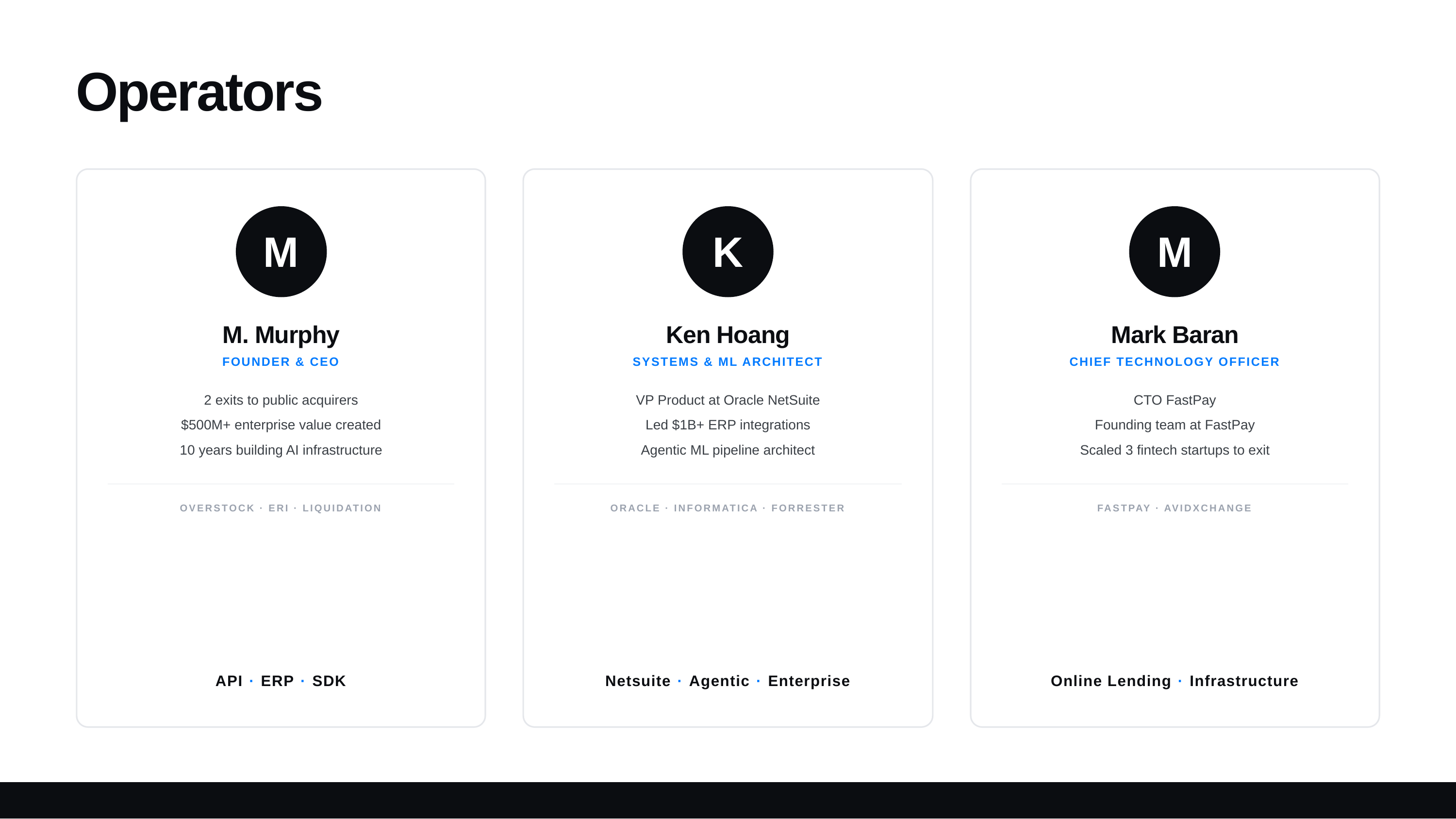

Team: Operators

Statement

We're the only ones positioned to solve this problem.

Evidence

M: 2 exits, $500M+ value. Ken: Oracle NetSuite VP, $1B+ ERP integrations. Mark: CTO FastPay, 3 fintech exits.

Close

We believe we've got a year's head start, and that no competitor can duplicate.

09

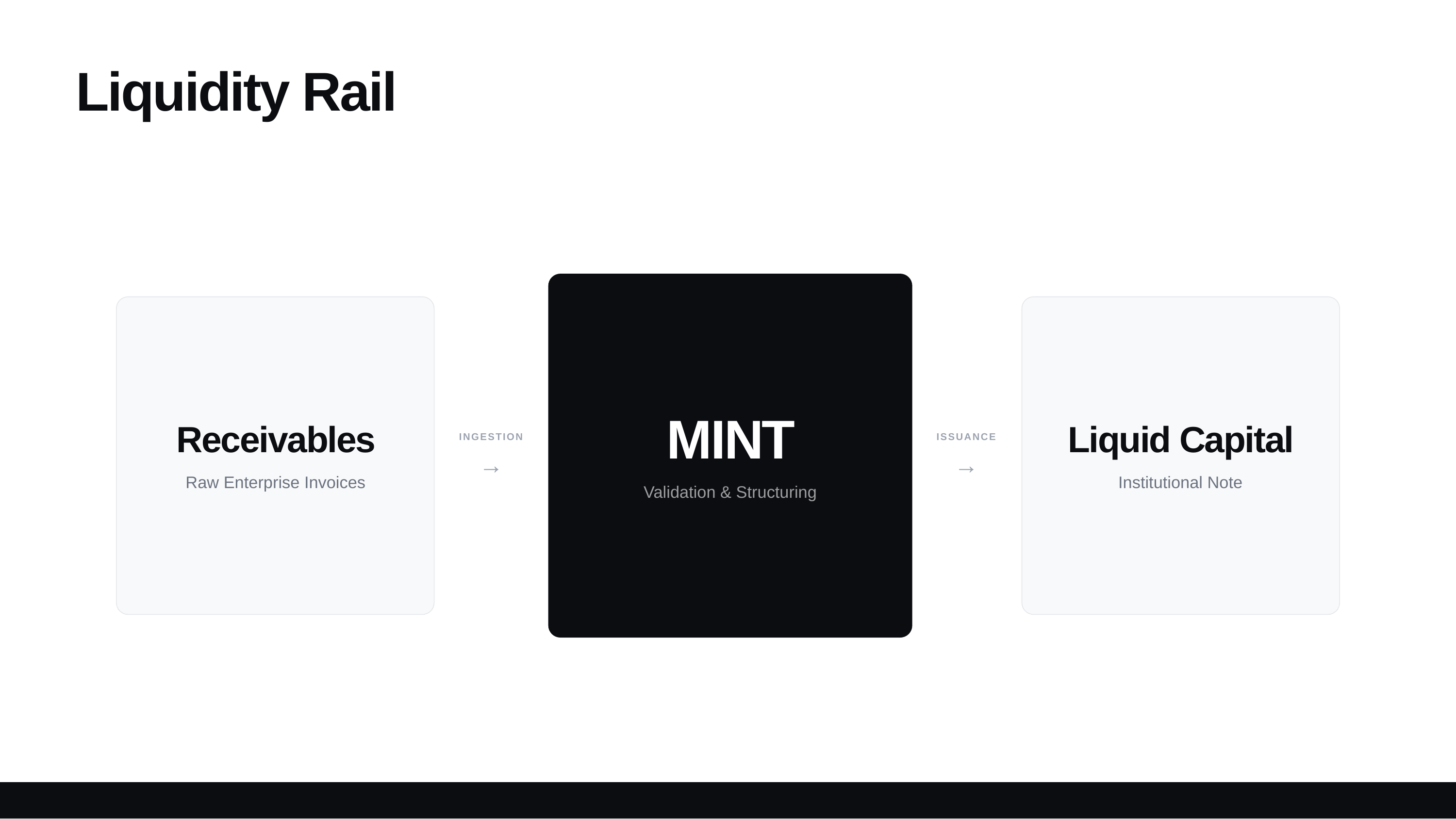

Solution: Liquidity Rail

Statement

We've built liquidity pipes that transform stuck debt into fast-moving liquid capital.

Evidence

Raw invoices → MINT validation → Institutional notes. 33M businesses, $25T receivables, $1.6T private credit.

Close

The only thing that matters in this space is that assets move faster, and we built a product to do just that.

10

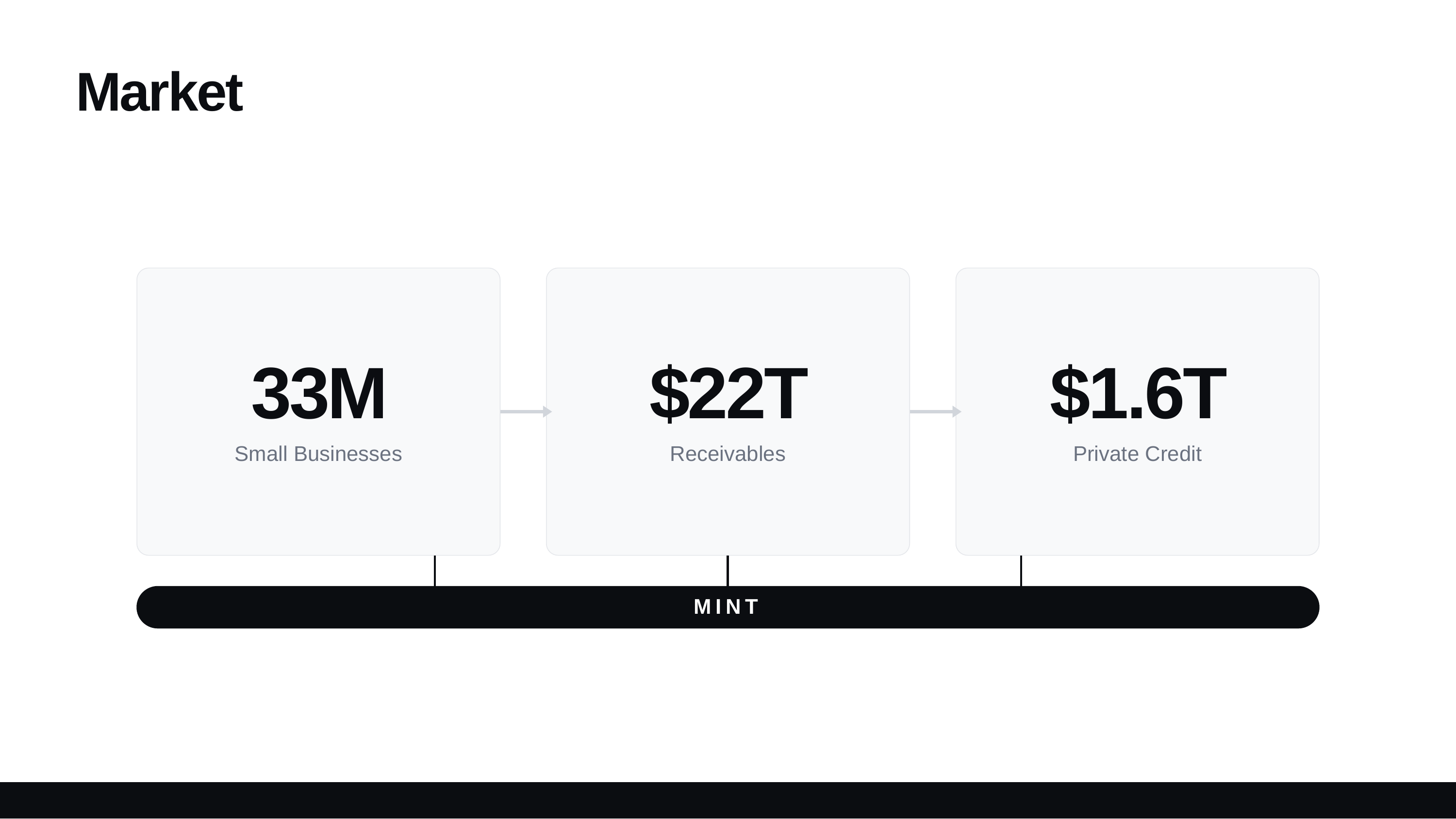

Market

Statement

The markets have been sitting in plain sight. They needed to be connected.

Evidence

Half the GDP is small businesses that need cash. There's $22 trillion in receivables that are stuck.

Close

Connecting in a lot of capital seeking yield.

11

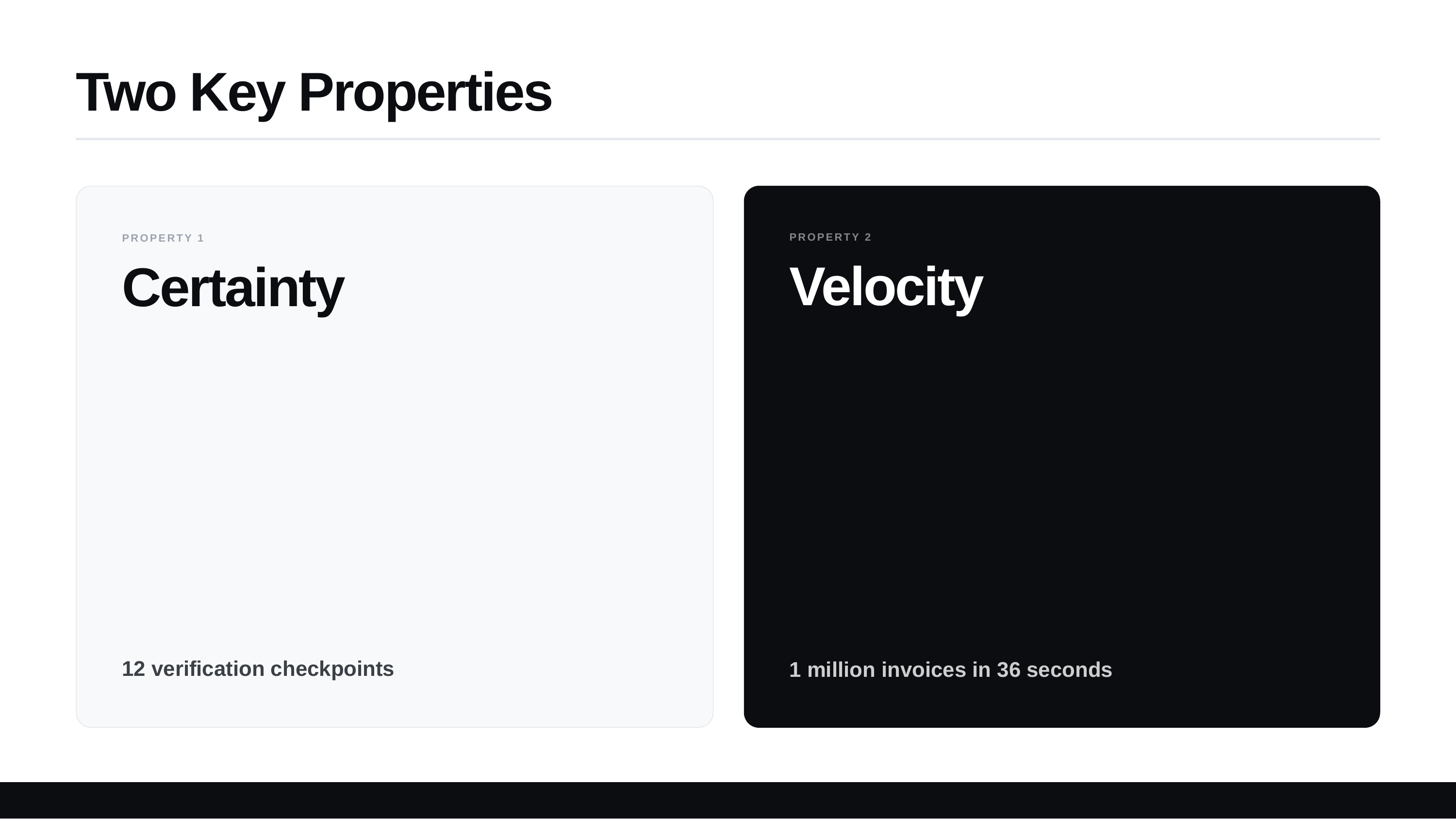

Two Key Properties

Statement

Two key properties that never existed in this space before.

Evidence

Certainty: 12 verification checkpoints. Velocity: 1 million invoices in 36 seconds.

Close

This is a quantum leap from anything we've ever witnessed.

12

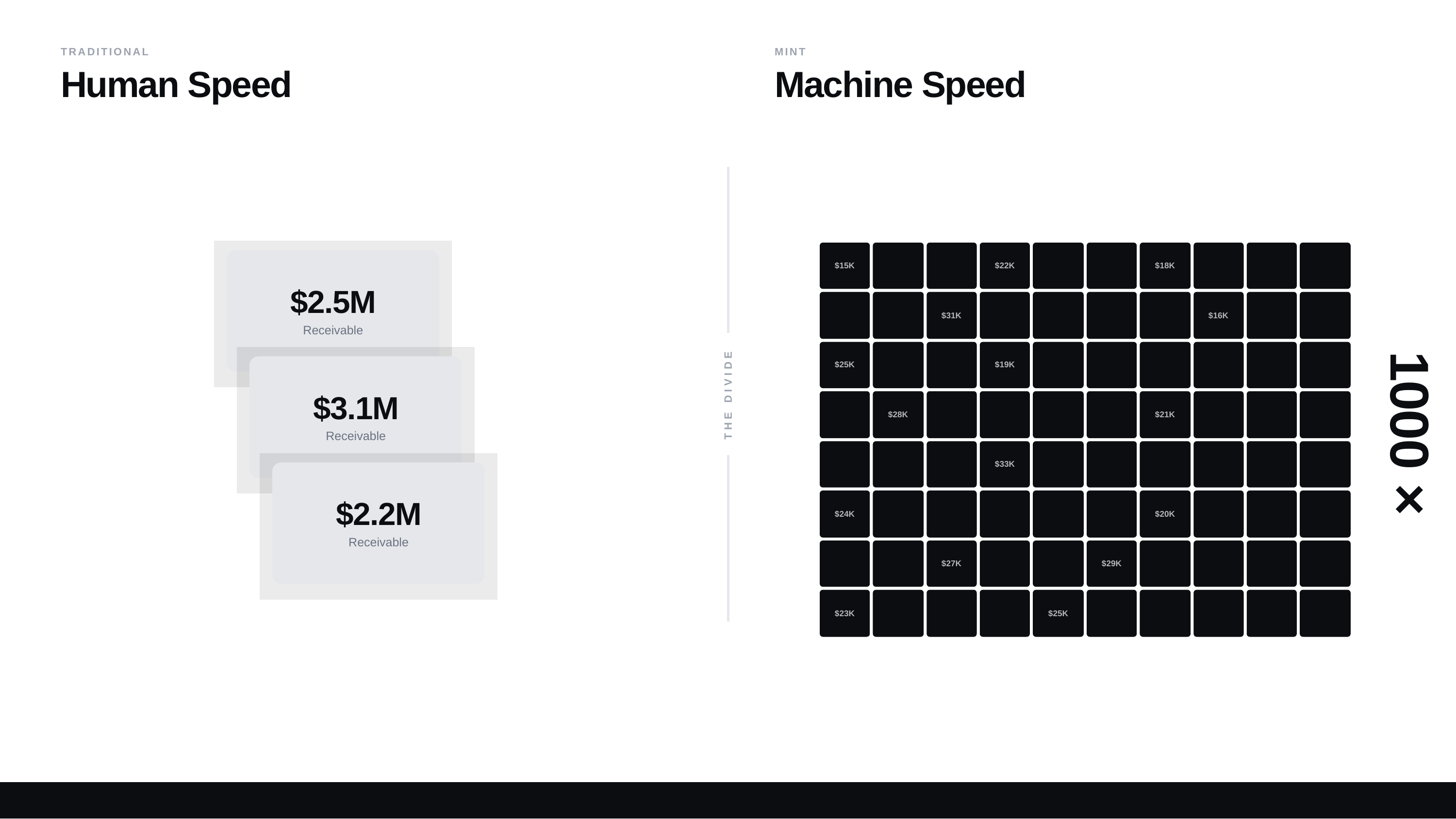

Machine Speed

Statement

Incumbents see $2.5M receivables. We see hundreds of $25K invoices moving at 1000X speed.

Evidence

Human speed: 3 large deals/quarter. Machine speed: Continuous flow, infinite scale.

Close

We get these assets in action and push them to fast transactions.

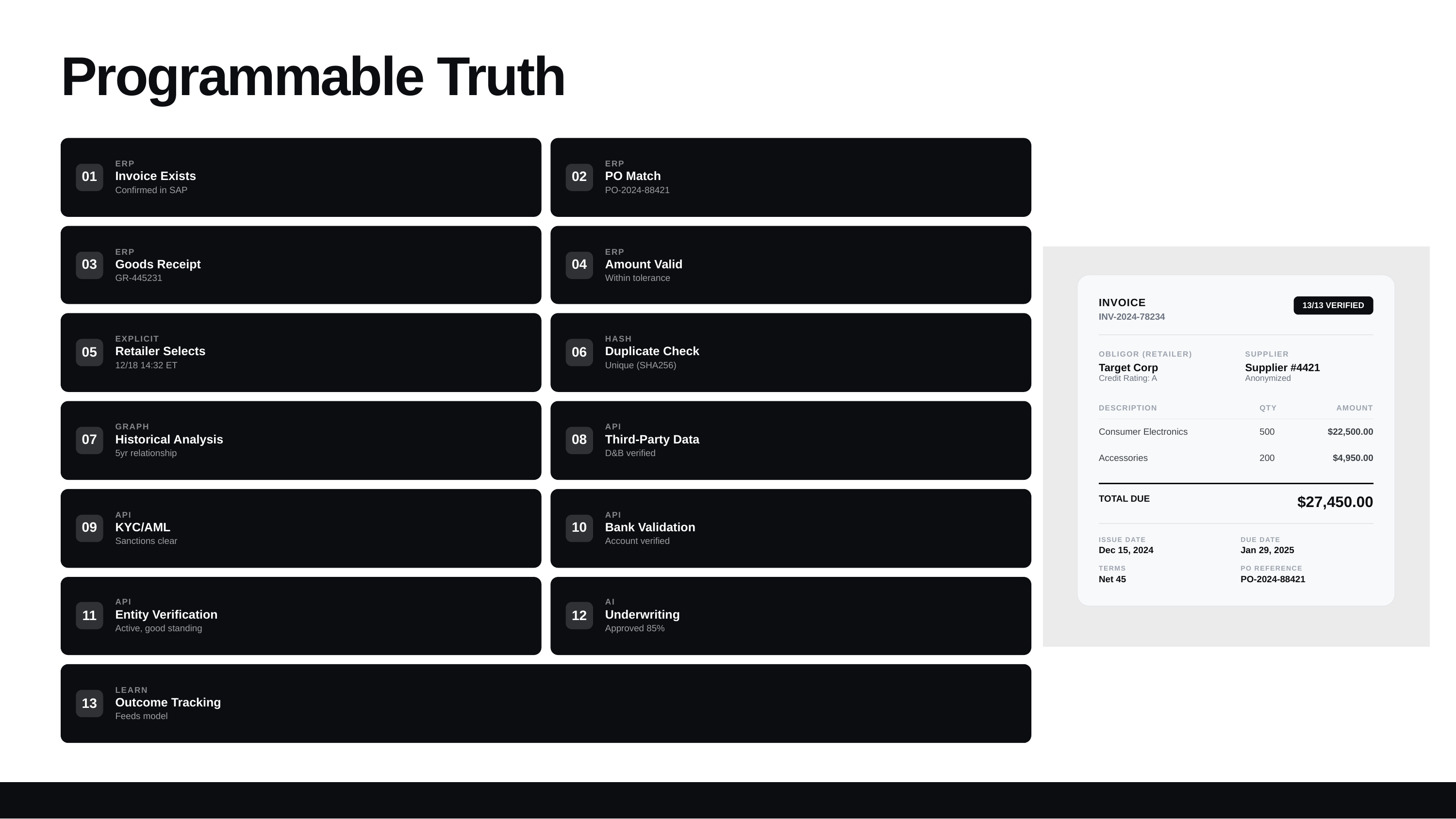

13

Programmable Truth

Statement

We don't predict. We verify. Every invoice passes 13 deterministic checks.

Evidence

ERP validation, PO match, goods receipt, retailer selection, duplicate check, historical analysis, KYC/AML, bank validation, AI underwriting.

Close

0.0001% chance of any traditional factoring fraud coming through MINT's defense.

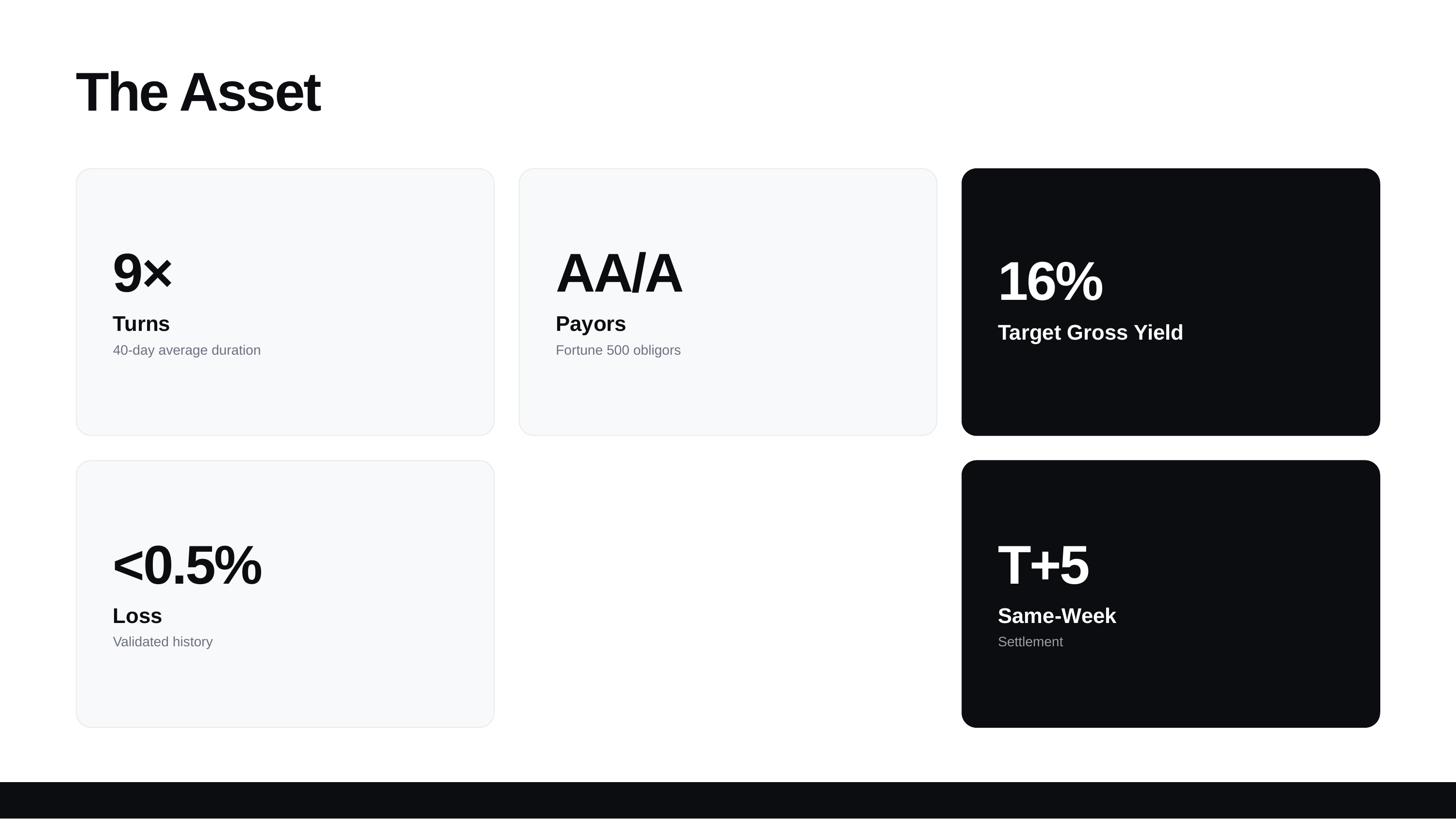

14

The Asset

Statement

Short duration, investment grade, enterprise backed. The asset LPs are looking for.

Evidence

9X annual turns. AA/A payors. 16% target yield. <0.5% loss. T+5 settlement.

Close

The intention to produce as much yield as fast as possible.

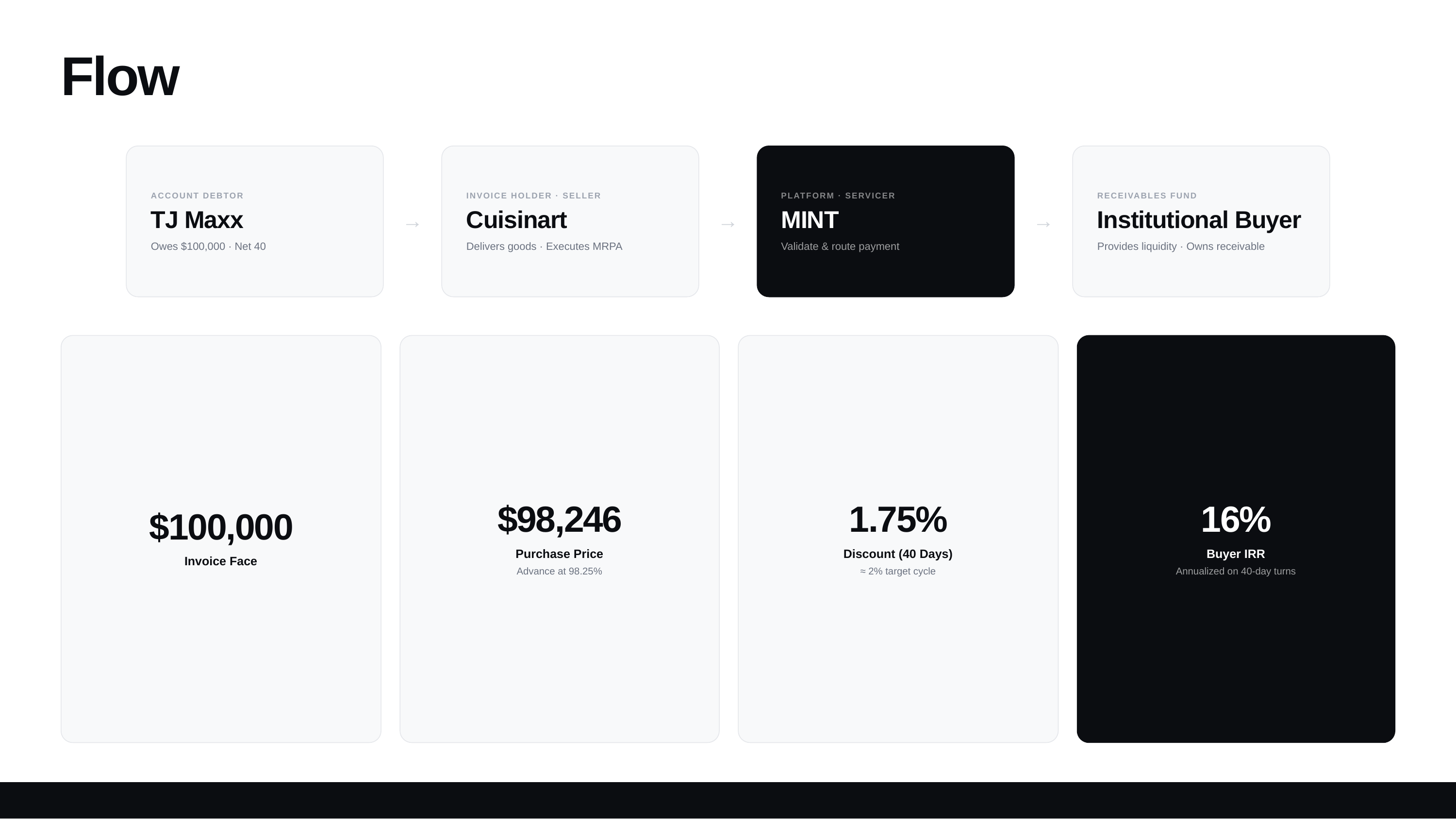

15

Flow: The Transaction

Statement

TJ Maxx owes $100K. Cuisinart gets paid today. Institutional buyer earns 16%.

Evidence

$100K face, $98,246 purchase price, 1.75% discount, 40 days, 16% annualized.

Close

Dead simple, repeatable yield.

GTM (16-18)

16

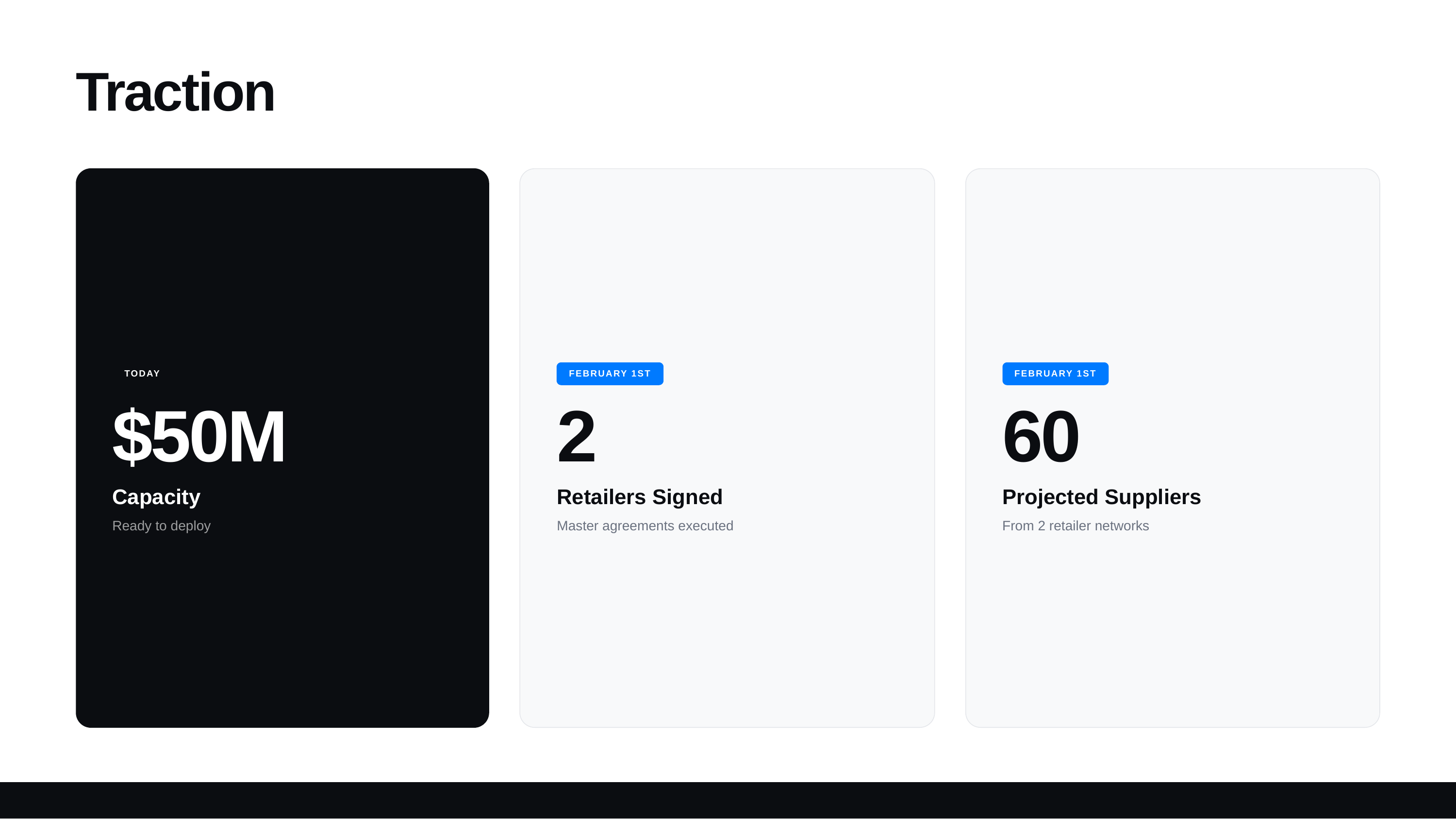

Traction

Statement

The capacity to produce $50 million today.

Evidence

$50M capacity ready. Two retailers signed, projected January. 60 projected suppliers.

Close

These retail agreements require a minimum number of suppliers, so we have confidence in the fast onboarding of sixty.

17

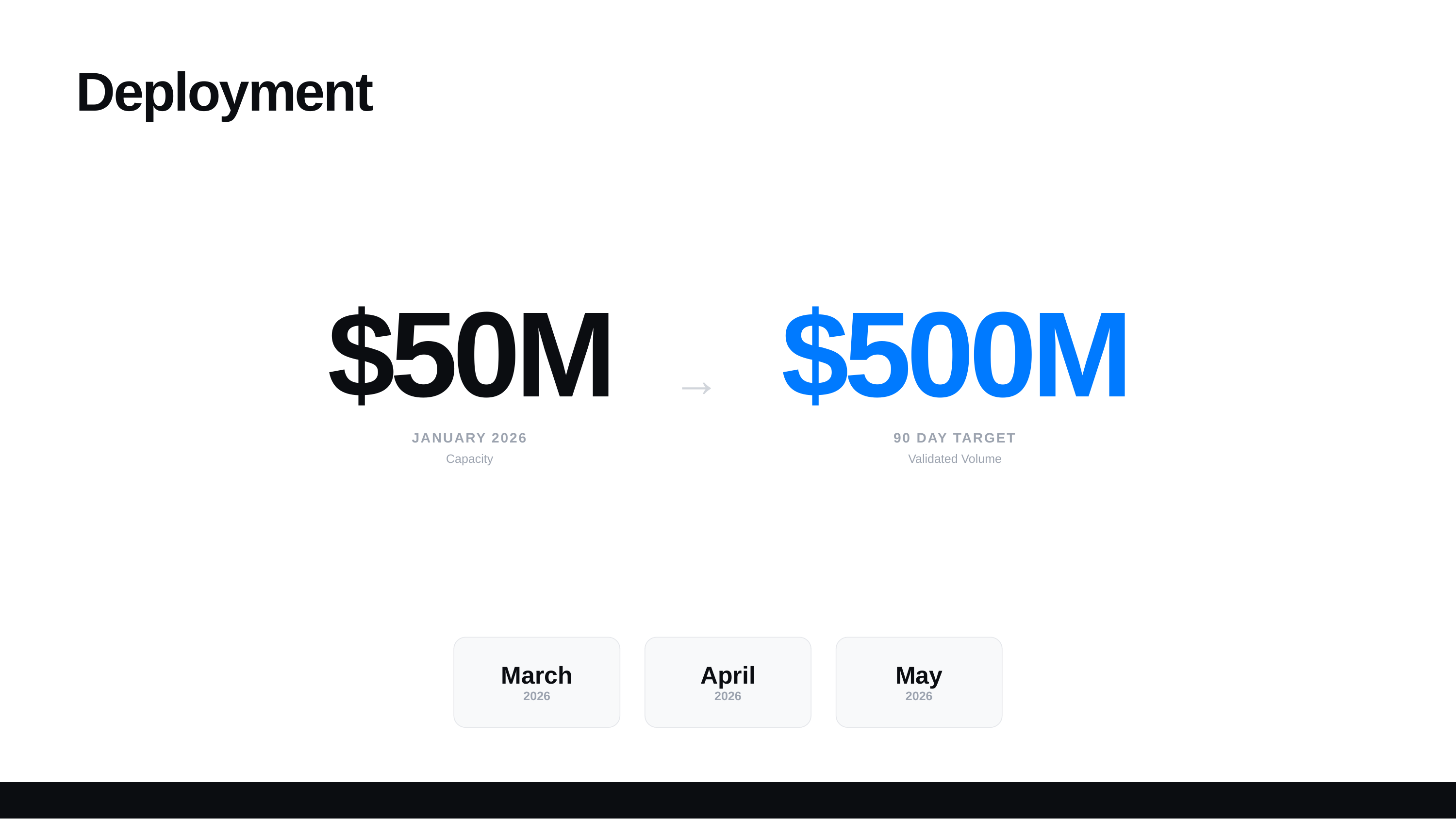

Deployment: The Ramp

Statement

From $50M to $500M in 90 days. This is what velocity looks like.

Evidence

January: $50M capacity. 90 day target: $500M validated volume.

Close

This is how we see the first half of 2026 playing out.

18

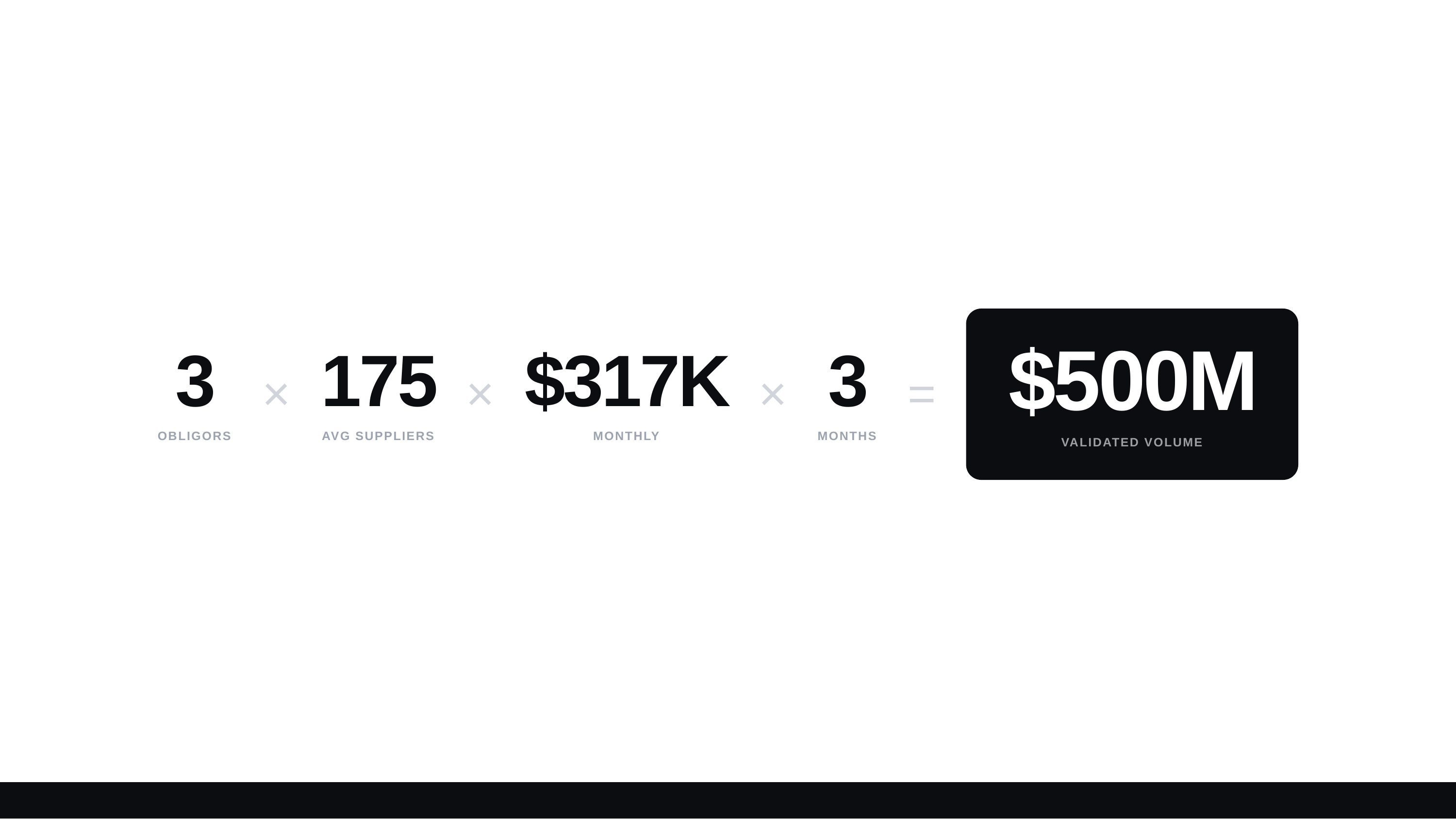

Math: The Model

Statement

Simple multiplication. Obligors x Suppliers x Volume x Time = Scale.

Evidence

3 obligors × 175 avg suppliers × $317K monthly × 3 months = $500M validated volume.

Close

By invite. Supply existing relationships. Trust built in.